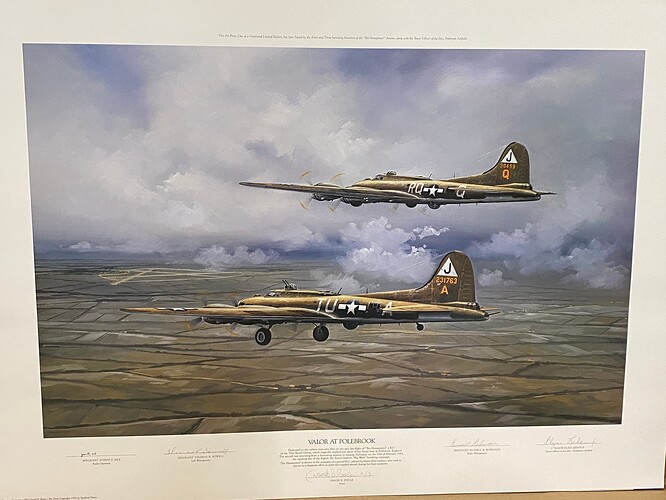

I picked up some military prints in an auction recently and have no idea how to price this one. It looks to be an original hand signed (in pencil) print signed by artist Gil Cohen and 4 of the surviving crew of the plane. Most likely dating around the 1990s. No COA provided but it looks pretty genuine. The title is Valor at Polebrook. Also it was a limited signing of FIVE copies. This one is 4 of 5.

That’s weird…Here’s another one signed by David B. Poole and four B-17 crew members

H.P.

Yeah I saw that page. Personally I think that be some B.S. automated A.I. pricing. ![]()

I mean the non-signed prints sell on eBay regularly for $100-$300 so this should be worth more than those.

For example this is a sold aviation print that was not hand-signed but merely re-printed with signatures. Limited to 1250 copies.

Pricing artwork. Ugh. Talk about dashing ones hopes and dreams on the rocks of reality. The thing about aviation art is that when it comes down to it, it’s a very small market. Like any collectibles, you’re not going to get what it’s worth or even what you paid for it unless you manage to sell it in the small clicque that collects it. My dad was an avid hunter and in the '70s and '80s bought several paintings by Maynard Reese, among others. Some of them were very low numbers in limited editions. Long story short, of about a dozen I only saved two that I particularly liked and the rest of them I sold. More like gave away. I called wildlife dealers far and wide. In the end, I received a pittance for what they were supposed to be worth. There are non-aviation interest collectors out there who will collect aviation art, but eventually the market tends to dry up. I have an original Wooten showing a B-17 being harassed by a 109 with a Spitfire coming to its aid. It’s signed by surviving crew members, and German and British fighter pilots. (It belonged to Russell, AKA Siderius, and his brother and sister gave it to me after he passed away.) it was my understanding that they wanted me to price it and sell it and give them the proceeds. I contacted some galleries and found out it would only bring in a couple hundred bucks, which is much less than what his dad bought it for. (His brother is an artist in Chicago. He would go a year or two without making a sale. And all the summer somebody would give him $25,000 for one of his works. The art world is a fickle place.). And another example, my mom collected a couple of original pastel landscapes from an artist who was eventually inducted into some association of landscape pastelists or such. I know that in 1994 I paid $1,200 for one of them. Last time I tried to have it valued, there’s only a couple hundred dollars. To sell something, you have to sell it at a time and place that people want it.

I actually started selling some art before I bailed out into flying as a profession. Nothing to write home about. Who knows what it would have happened if I’d stayed in it? But I know that of my five friends but I was in art grad school with, only two of the five got jobs in art and pursued it, and only one stayed with it beyond 10 years. I suppose my favorite achievement is that for a whopping $20 and bragging rights, I won a logo design competition amongst art students for a child welfare nonprofit, and 37 years later they are still using that logo.

The sum it all up, the only reason to buy aviation art or any of the art depicting military sayings is if you personally like it. Buy it at the price that you enjoy, and enjoy it. And who knows? Maybe someday you can get your money out of it, or the artist will die and it will multiply in value exponentially.

Sorry if these musings are not helpful.

Free

“I actually started selling some art before I bailed out into flying as a profession. Nothing to write home about. Who knows what it would have happened if I’d stayed in it?”

Is this you way back when??? ![]()

Basically what Fred said, it is a minefield. I worked for a big auction house for several years in their Prints dept. & learned all the tricks. Before colour lithography, “prints” were rolled off from copper or steel plates, often aquatinted or hand-coloured. Actual lithographs were rolled off from stone bases, hence “litho”. All of the above were run in either unlimited editions, or genuine signed/numbered editions after which the plate/stone was destroyed.

But modern (generally 20th century onwards) colour lithographs are effectively just reproduction photos of original paintings. Salvador Dali & Joan Miro were amongst the worst abusers, signing thousands of blank sheets (and sometimes false-numbering them) which were then rolled off with a photo of their original paintings. To this day owners believe they’re worth thousands, when in reality all they’ve got of any value is a scrawled autograph.

I can’t read the small print on your print, if you could post blow-ups I might be able to say if those autographs are real, or just part of the reproduction.

Ultimately, unless there’s an authenticating certificate (and a vendor guarantee) that it’s an “original” limited edition, it’s just a better-quality poster…and worth whatever one is prepared to pay for it.

I’m not one to brag but…

… I am the one that bought that masterpiece.

![]()

![]()

![]()

Tim, et. al, when I cleaned out my mom’s house I was curious what the artwork was worth and called around to have it appraised. That in and of itself can be shocking. I talked to four or five or six galleries, and every one of them wanted to be paid - per piece - to appraise the value of the art. Now granted they should know if the artists are anyone in demand or not, but the cheapest one wanted about $400 per appraisal. There might be one or two pieces that could be worth assessing, but in the end I let my mom’s best friends take a piece home, and the rest I either have in storage or brought back east with me. Something tells me that for the amount I paid in storage so far, I could have bought the art over two or three times fold. But hey, we value things for different reasons.

Any object or commodity is worth exactly, down to the pennies, what someone else is willing to pay for it (I know I am stating the obvious …).

The only way to find out the actual value of something is to try and sell it.

If the market is lively there is often a daily report of the actual price (the stock markets, oil trading and a few others are prime examples).

A single buyer can drive up the price for a specific item but once that buyer has concluded the transaction and is satisfied there might not be another buyer willing to pay that price.

If ten identical items, for instance numbered prints, are auctioned off at the same auction site with a few days interval the first will be sold for the price that the most eager buyer is willing to pay.

Once that buyer is “out of the game” the next highest bidder in the first auction may or may not bid on the second item. When the sequence of auctions reaches the last item there might not even be any remaining buyers around and the item can go unsold.

The fact that a very similar item was sold for X dollars a month ago doesn’t change the fact that the last item was essentially worthless. Who knows, 5 years later it might even be worth twice as much as the first item beacuse a new group of buyers/collectors have turned up.

The apartment I bought went for a much higher price than estimated by the real estate agents simply because there were some silly buggers who wanted it just as much as I did but didn’t have the financial muscle.

If they had not been around I would have paid 25-30% less than I did. If someone had tried to sell an almost identical apartment a few weeks later my opponents would have bought it for far less than their highest bid against me.

Yes indeed art valuation is another game, it’s the same in Oz. Obviously appraisers have costs – travel perhaps, certainly time, and research time to check current auction values. It’s tricky to find a fair balance, given everyone’s art stash is different in both quantity and quality. I’d say the fairest is an overall basic assessment cost based on time to grasp the scale of the stash – say $250. Then a second quote for the required research/documentation time – fixed, not negotiable. People need valuations not only for an idea of sale prices, but also straight insurance cover.

All true. One big advantage of auctions – as opposed to selling through a dealer or individual – is the market value is publicly established. A dealer’s likely to offer you 50% (or less) of its true value so he can make a fat profit. Auctioneers make their cut from an approx. 10% commission of the sale price from the vendor, and around the same from the buyer. Percentages vary of course.

And yes there is a risk going to auction that the punters (especially dealers) form a “buyers’ ring” – they agree between themselves before the auction they won’t bid against each other, thus suppressing the sale price, and afterwards they sell those lots and split the profits. Good auctioneers are adept at detecting and preventing rings, I wouldn’t risk selling anything via small-time auctioneers.

As for what is market value, yes two lunatics can bid against each other and send something way beyond its previously established/accepted value. For Auctioneers & appraisers alike, they need to research freak sale prices against previous comparable examples, in order to quote to a new person selling a similar item a more sane valuation.

Just as an example, there was a relatively small-scale auction here in Sydney of a vast collection of antique toys a couple of years ago. I spotted a large tin-plate Alfa Romeo car (c. 1920) which was estimated at A$3,000 - A$4,000. It was a rare colour (orange) in great condition, and after a couple of hours research I knew it was worth approx. A$15,000 – and I was prepared to bid up to that. Guaranteed positive investment.

But I also know Auctioneers deliberately under-estimate some items to suck in people like me who knew something.

So there I was, finger trembling on mouse at the on-line auction. What did it sell for? A$23,000. You could say I saved a lot of money. Two bidders went bananas and I’d guess the winner might break even selling it again in….5 years time? Maybe more.

So if similar item came up again, what would its estimate be?

The aviation print market is dominated by original paintings to which prints can be signed by notables such as German aces, American WWII notables, famous Brit aces and Lancaster crews. Stunning art is secondary. Robert Taylor for example fits the criteria in addition to the promotion network he was part of.

From a different perspective buyers gravitate to Memphis Belle prints signed by Col Morgan rather than the signers of Mr. Cohen’s print here. No disrespect to Mr Cohen and not a promo for Taylor either, in a market dominated by dealers one will only get what they will pay in order to make their profit. If the objective is financial gain, best to see what dealers are asking and then sell for the same or greater price on your own .

Basically signatures of key notables sell.

Key notables